Economic woes put litmus test to John Lee

Former Hong Kong financial services minister Fred Ma Si-Hang is not known as a pessimist. That he had talked in length of gloom, if not doom, about the city’s economy in a recent media interview, is simply because he was only telling the truth.

Evidence is aplenty that the Hong Kong economy and public finance are worrying. More worryingly, the Hong Kong SAR government does not seem to have taken it seriously.

Speaking at a media briefing two days after the Chinese National Day, Chief Executive John Lee Ka-chiu said the return of the fireworks show at Victoria Harbour was a sign of the end of the city’s difficult times – and the beginning of a full return to normality.

That would be too good to be true to doubters such as Fred Ma, chairman of Hong Kong insurer FWD Group Holdings, which is backed by tycoon Richard Li Tzar-kai.

In an interview with online media Hong Kong 01, Ma lamented the current state of Hong Kong economy was the worst in the past two decades. Citing the second quarter GDP figure was worse than predicted, he said all key economic pillars were in trouble.

“We had been backed by the Motherland in the past. Now, our Motherland has a lot of problems on their own plate. (We) no longer have backing.”

The outburst of Ma came amidst calls from local business sectors one after another in the past few weeks for Lee to give quick fixes to ease their woes.

Then came the “Night Vibes Hong Kong” campaign launched by the Government around the extended Chinese National Day holiday in the mainland, featuring three night bazaars at both sides of the Victoria Harbour during the holiday period.

Lee said it would be regularly held on selected sites during weekends and holidays. This is despite doubts cast by business figures and the general public about the concrete contribution of night markets to the overall economy.

Pressure is also mounting for the Government to ease, if not abolish, a set of property cooling measures in a bid to prop up the weak property market. The sluggish stock market, meanwhile, has prompted calls for the Government to cut stamp duty for stock transactions to spur trading of stocks.

Financial Secretary Paul Chan Mo-po has given a strong hint earlier that the curbs would be eased. But the chance of total abolition of the curbs looks slim in view of officials’ fears of a fresh surge of property prices.

Chan said the conditions that prompted the authorities to impose these measures starting in 2009 no longer prevailed.

It is uncertain, however, whether stamp duty would be drastically cut because revenue generated from stock trading has formed a significant part of recurrent revenue.

But even if Lee acts to stimulate the property and stock markets and to install night bazaars along the waterfront and in more places, the chance of a return of the economy to full vitality is seemingly slim.

Likened as the “backbone” of Hong Kong’s economy and as a whole, the mainland economy has slowed down for various reasons, including the debt crisis faced by property firms and weak exports.

Whether the Chinese economy has already peaked and has entered uncharted waters is anybody’s guess. But the negative impacts of the mainland’s slowing economy on Hong Kong have already surfaced, posing a huge challenge to the Lee administration.

Lee joined the Government as a police inspector in the 1980s and had largely handled security-related jobs since then before he was promoted to become the Chief Secretary in 2021.

His elevation to become the Chief Executive last year has been interpreted as the beginning of a new era with “armed officials ruling Hong Kong,” aiming to restore order and ensure strict enforcement of policies and decisions in the aftermath of the 2019 social unrest.

With stable political and social order, Beijing is adamant economic prosperity will return, thus giving a big help in solving such chronic livelihood problems as “subdivided flats” and poverty.

If this is Beijing’s post-2019 game plan for Hong Kong, it is now in disarray.

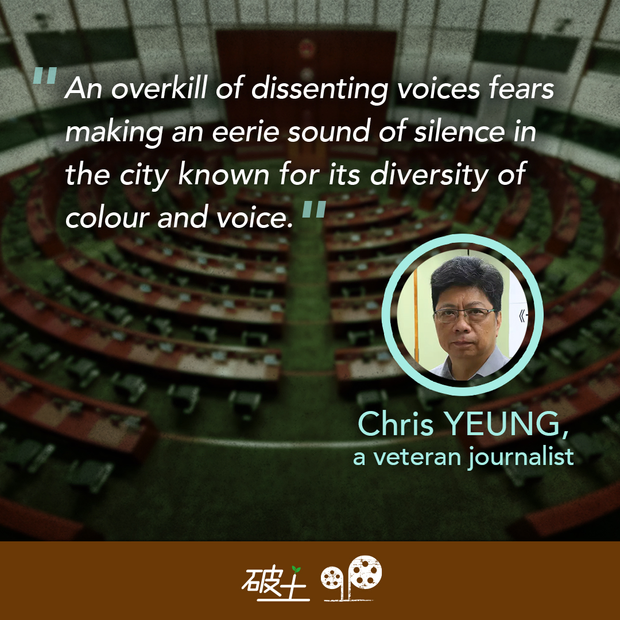

More than one year after taking office, Lee may have won full marks for curbing political dissenting forces and securing stability.

But the city has slipped into economic and financial quagmire, putting perhaps an unexpected test on Lee’s unknown knowledge and ability in putting Hong Kong back on the path of economic growth.

▌[At Large] About the Author

Chris Yeung is a veteran journalist, a founder and chief writer of the now-disbanded CitizenNews; he now runs a daily news commentary channel on Youtube. He had formerly worked with the South China Morning Post and the Hong Kong Economic Journal.